If you have ever tried buying property in Bangalore, you know how confusing the paperwork can get. Words like sale agreement and sale deed keep popping up, and most of us end up wondering, are they the same thing? Do I need both? And more importantly, how do these documents affect my ownership?

Don’t worry! In this article, we will break it all down for you. So, you will learn:

- What a sale agreement is.

- What does a sale deed mean?

- The key difference between sale and agreement to sale.

- How to calculate stamp duty and registration charges in Bangalore.

- The common mistakes buyers usually make.

By the end of this, you will know exactly what to watch out for when you buy property without needing to flip through legal textbooks.

Table of Contents

ToggleWhat Is a Sale Agreement?

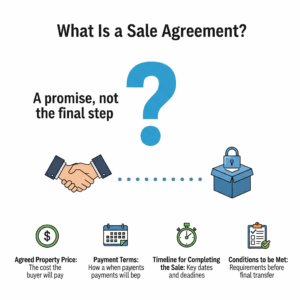

You can think of a sale agreement as a promise. It’s not the final step, but rather the step before the final step. When you and the seller agree on a property deal, you put that agreement in writing. That’s what a sale agreement is.

This sale agreement typically has these things:

- The agreed property price

- Payment terms like advance amount, balance, etc.

- The timeline for completing the sale.

- Conditions to be met before the final transfer.

If we talk about Bangalore, then here, a sale agreement is more of a safeguard. It makes sure that neither the buyer nor the seller backs out suddenly. Although, legally it does not give you any ownership rights, it does give you a strong foundation to proceed towards a sale deed.

This is why it’s very important to distinguish between sale and agreement to sell. A simple way to remember this is Sale Agreement = Commitment!

What Is a Sale Deed?

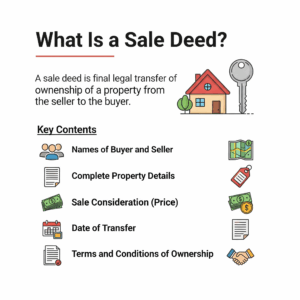

Now comes the big one: the sale deed. Unlike the agreement, a sale deed is the final legal transfer of ownership from seller to buyer. In fact, without a sale deed, you cannot call yourself the true owner of the property!

How is it done? Simple! A sale deed is registered at the sub-registrar’s office in Bangalore and usually contains details like:

- The names of the buyer and seller.

- Complete property details.

- The sale consideration (final price paid).

- Date of transfer.

- Terms and conditions of ownership.

And once this sale deed is signed and registered, congratulations, the property is legally yours! You can now sell it, mortgage it, or gift it, anything, it’s all your asset after all!

A simple way to remember the confusion of the difference between sale and agreement to sale is Sale Deed = Ownership!

Key Differences Between Sale Agreement and Sale Deed

Let’s distinguish between sale and agreement to sell with an easy table:

| Point | Sale Agreement | Sale Deed |

| Purpose | A commitment to sell/purchase | The actual transfer of the ownership |

| Timing | Happens before the sale deed | Executed after all terms are met |

| Legal Status | Doesn’t give ownership rights | Confirms legal ownership |

| Registration | Usually optional, but recommended | Mandatory |

| Usefulness | Protects both buyer and seller until the final sale | Makes the buyer the legal owner |

So, in short, without a sale agreement, the deal basically lacks the structure. Without a sale deed, the deal does not have any legal standing. This means that both are important for very different reasons.

How to Calculate Stamp Duty and Registration Charges in Bangalore

If you are buying property in Bangalore, then here are two unavoidable costs for you to keep in mind: stamp duty and registration charges. Many people ask, “How To Calculate Stamp Duty and Registration Charges In Bangalore?” The answer is: it depends on the property value, buyer category, and property type.

Step 1: Check the Guidance Value

Step 2: Apply the Stamp Duty Rate

Step 3: Add Surcharge on Stamp Duty

Step 4: Add Registration Charges

Step 5: Add Cess (if applicable)

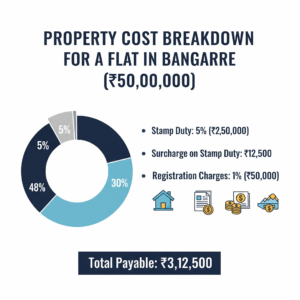

For example, suppose you buy a flat worth ₹50,00,000 in Bangalore.

- Stamp Duty @ 5% = ₹2,50,000

- Surcharge on Stamp Duty = ₹12,500

- Registration Charges (1%) = ₹50,000

Total payable = ₹3,12,500

So if you are wondering how to calculate flat registration charges in Bangalore, the process is the same. Only the property type (apartment vs. plot) changes the value considered, rest all is pretty much the same!

Common Mistakes to Avoid

What most beginners in real estate don’t know is that even seasoned buyers sometimes get caught up in legal traps. And it’s not even the big stuff, but really basic things, which sometimes can be hard to keep a check on. Below are the top mistakes you should avoid:

- Skipping the Sale Agreement tops the list, as there are some buyers who directly jump to a sale deed. This can really backfire if any dispute arises.

- While it is an option, not registering the sale agreement can be problematic, so make sure you do add it for more security.

- Ignoring the stamp duty and registration charges is another big financial oversight, which is surprisingly very common!

- Always check and verify the property title and ownership before you sign anything!

- A lot of people just rely on verbal promises, but in the real estate world, that does not work. Unless it is in the agreement, it does not exist legally, and well, no one is keeping a track of what’s been said over a call.

Also Read :What Is Stamp Duty & Registration Charges in Bangalore?

Why Choose Guru Punvaanii?

At the end of the day, property buying is more than just paperwork. It’s about trust, and that is exactly where Guru Punvaanii shines! We are here to guide you through every step from the sale agreement to sale deed.

We will guide you through the difference between sale and agreement to sale. This also includes making sure that all stamp duty and registration charges in Bangalore are clearly explained upfront. So there will be no hidden surprises, and you will get full transparency and customer-first service.

Also, the best part? Our projects are RERA-approved and legally all clear! So with us, you never have to worry about any hidden disputes. We all know how buying property is a big milestone, and to make that a smooth journey for you, we are here to help!

Conclusion

The world of property documents can feel very overwhelming at first. But now that you know the difference between sale and agreement to sale, it will be easier to navigate through your next investment.

- A sale agreement secures your deal.

- A sale deed makes you the legal owner.

Remember to account for stamp duty and registration charges in Bangalore; you must avoid making the common mistakes many people make. Also, most of the time, it’s all about choosing a trusted builder like Guru Punvaanii so the whole process can be seamless.

Your dream home is too precious to risk on unclear paperwork, so get it right and enjoy your peace of mind.

Frequently Asked Questions

1. Is there any difference between a sale deed and a sale agreement?

Yes! A sale agreement is a commitment to sell, while a sale deed is the final legal transfer of ownership.

2. Is a sale agreement valid after a sale deed?

The answer is no. Once the sale deed is executed, the sale agreement becomes redundant.

3. Who keeps the original sale agreement?

Usually, the buyer keeps the original sale agreement, while both parties retain a copy.

4. Can buyers cancel a sale agreement?

Yes, but cancellation terms should be mentioned in the sale agreement itself to avoid any disputes.

5. What is the limitation period for a sale deed?

The limitation period for a sale deed is typically 12 years for filing disputes related to ownership.