While purchasing a home, one of the most prevalent dilemmas for property buyers is to decide between under construction flats and ready to move in properties.

A major factor in decision-making here is the occupancy certificate (OC) status. Properties that lack an OC are levied with Goods and Services Tax (GST), entail waiting for possession, and can have execution risks.

Conversely, those with an OC are legally available for occupation, enjoy no GST, and provide instant useability.

Therefore, the fundamental question: do you choose under construction flats with lower entry points and appreciation prospects or do you take the certainty and convenience of ready to move in apartments?

In this article demystifies the costs, taxes, risks, financing, and returns so that you can make an informed choice.

Table of Contents

TogglePrice and Total Cost of Ownership

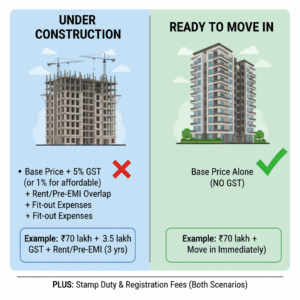

A key draw of under construction apartments is their lower base price tag. Developers tend to start projects at reasonable prices, providing early-bird discounts. But the cost of ownership has to account for more than the sticker cost.

For under-construction flats:

- Base price + 5% GST (or 1% for applicable affordable housing).

- Rent + pre-EMI overlap till possession.

- Fit-out expenses after the flat is handed over.

For ready to move in flats:

- Base price alone (no GST).

- Stamp duty and registration fees are paid in both scenarios.

For example: A ₹70 lakh under-construction property might incur an extra ₹3.5 lakh GST. If construction is for three years, you might also pay rent in the meantime, in addition to pre-EMIs. The same-valued ready-to-move flat would avoid GST altogether, and you can save on rent as you can move in straight away.

Taxes and GST

The regime of GST has established a distinct cost differential between the two types of properties.

- Development flats invoke GST at 5% (or 1% for low-cost projects). Crucially, buyers do not have input tax credit on this payment.

- Ready to move properties with valid OC are exempt from GST. Buyers simply pay stamp duty and registration fees.

Practical advice from Guru Punvaanii: Always ensure the OC has been issued prior to purchase. Also, watch out for other taxable charges such as clubhouse or parking charges, which may still incur GST if charged separately.

Possession Timelines and Certainty

With under construction flats, possession will vary based on the under construction property.

- While contracts provide for a date of handover, due to funding, approval, or labour shortage issues, delays are the norm.

- Ready-to-move-in apartments provide assurance. You can visit the actual apartment, verify for snags, and occupy it as soon as registration is done.

The cost of time cannot be overlooked; rent and EMI overlaps during delays can play havoc with your finances. For most buyers, the comfort of occupancy on day one is more than a premium price tag.

Risk and Legal Safeguards (RLSA Focus)

The Real Estate (Regulation and Development) Act (RERA) has enhanced transparency for flats under construction, but there are still risks involved.

Safety measures include:

- RERA registration and public disclosure of project information mandatorily.

- Delayed possession compensation with interest.

- Five-year defect liability after handover.

But as Guru Punvaanii points out, even then buyers must:

- Verify builder’s RERA registration page.

- Keep allotment letters, payment receipts, and communications.

- Read sale agreements carefully for penalty clauses.

For ready to move in apartments, the primary protection is confirming the OC and ensuring that the property is clear of encumbrances.

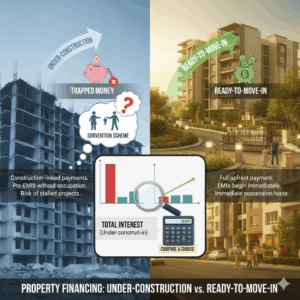

Financing and Cash Flow

Financing is different for both types of properties.

Under-construction apartments typically have a construction-linked payment schedule. EMIs begin as pre-EMIs on the loan that has been disbursed, which can go on for years without the advantage of occupation.

Subvention schemes (when the builder pays the pre-EMIs) can simplify the situation but then have the underhanded risk of trapped money if the construction halts.

Ready-to-move-in apartments need almost-full upfront payment at acquisition. EMIs begin right away, but because you can take possession or lease the building immediately, cash flow recovers quicker.

Astute buyers ought to compute overall interest expenditure under scenarios to determine which suits their long-term needs.

Customization and Specifications

Customization is one often not-given-enough-thought aspect.

Off-the-plan properties do provide some leeway; purchasers can order layout adjustments or finish upgrades during the construction process. That said, changes are circumscribed by builder protocols and involve the threat of “variation clauses.”

Ready-to-move-in flats reveal what you will receive. Options for customization are limited, but the advantage is that you see the actual unit rather than working from brochures or demo flats.

Investment and Returns

From an investment standpoint:

Under-construction flats enable entry at a lower cost. As milestones of construction are achieved, value of the property generally increases. Yet, there is greater execution risk—if the project is held up, your capital is trapped.

Ready to move in apartments give immediate rental return and have lower vacancy risk. While capital growth might be sluggish compared to early-stage properties, the guarantee of returns makes them attractive to several investors.

Liquidity too varies; completed units are more easily disposed of, while under-construction apartments are greatly dependent on the mood of the market.

Hidden Costs and Due Diligence

Apart from base price, the following should also be budgeted for:

- Floor rise charges, preferential location charges (PLC), clubhouse fees.

- Maintenance deposits, parking charges, society formation costs, and sinking fund contributions.

Due diligence is a must: verify land title, approved building plans, encumbrance certificates, and completion/occupancy certificates. Always visit the site to determine construction quality and neighbourhood infrastructure. Guru Punvaanii stresses that skimping on due diligence will cost buyers much more down the line.

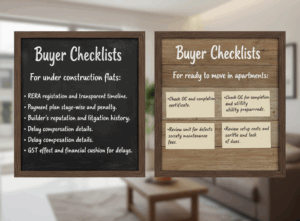

Buyer Checklists

For under construction flats:

- RERA registration and transparent timeline.

- Payment plan stage-wise and penalty.

- Builder’s reputation and litigation history.

- Delay compensation details.

- GST effect and financial cushion for delays.

For ready to move in apartments:

- Check OC and completion certificate.

- Check unit for defects and utility preparedness.

- Review setup costs and society maintenance fees.

- Double-check clear title and lack of dues.

To wrap up

The under construction vs. ready-to-move property – what is better?

Debate has no blanket response. If you are risk-averse, can wait, and are willing to take on some risk for future appreciation, under construction apartments might suit your needs.

If certainty, convenience, and instant use matter most, ready-to-move-in flats obviously triumph.

Finally, the choice lies with your investment goals, timeline, and budget. As Guru Punvaanii recommends, do a proper due diligence, compare overall expenses, and make the decision in line with your plan.