Buying a property in Bangalore is a dream for many. But along with the excitement of finding your perfect home or villa plot, there comes a not-so-fun part that is understanding the stamp duty and registration charges in Bangalore.

Most people think, “I’ll just pay what the builder or agent tells me,” but knowing what is stamp duty and registration charges are saves you from last-minute surprises. Don’t worry. If you’re also in the middle of these “I-don’t-know-what-to-dos,” you’re not alone. In this article, we’ll break it all down in simple terms: what stamp duty is, what registration fees are, how much you’ll pay in Bangalore, and how to calculate everything. Think of this as your friendly guide before you step into your new home or gated villa plot.

Table of Contents

ToggleWhat Is Stamp Duty & Registration Charges?

Let’s start with the basics.

- Stamp Duty is a type of tax you have to pay to the state government whenever you buy a property. It’s like the government’s way of saying, “Congrats on your new place, now pay us our share so it’s legally valid.” So whether you go for land, a villa, or an apartment, this step is important!

- Registration Charges are the fees you pay to officially register your property in your name. Without this step, the property won’t be legally yours on paper, no matter how much you paid.

Now, you may wonder: what is the difference between stamp duty and registration fees? It’s actually pretty easy to understand!

On one hand, Stamp duty = tax on the property transaction.

And on the other hand, the Registration fee = the cost of entering your ownership details into official government records.

Basically, you can think of it like this: stamp duty is the entry ticket to the property world, while registration charges are the formal stamp on your name in the record book. When you put them together, you can then get the complete cost, known as stamp duty and registration charges in Bangalore.

How Much Are Stamp Duty Charges in Bangalore?

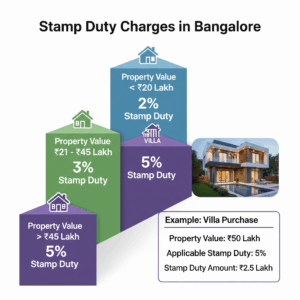

Here’s the part everyone is curious about: stamp duty charges in Bangalore. And guess what? The state government has fixed these charges based on the property value.

Here is the breakdown:

- 2% – if the property value is less than ₹20 lakh.

- 3% – if the property value is between ₹21–₹45 lakh.

- 5% – if the property value is above ₹45 lakh.

So let’s say you buy a villa that is worth ₹50 lakh. This means your stamp duty charges in Bangalore would be 5%, which comes to ₹2.5 lakh. This is why knowing Karnataka property registration charges matters. This is what many people miss, and later regret not counting these charges in their budget.

So, whenever you hear someone say “budget for extra costs,” what they actually mean is the stamp duty charges in Bangalore plus the registration fee. These rates apply whether you’re buying an apartment, an independent home, or a gated villa plot with Guru Punvaanii.

Additional Cess & Surcharges

But wait, there’s more! On top of the basic stamp duty charges in Bangalore, the government also collects a cess and a surcharge!

- A cess of 10% on the stamp duty amount

- A surcharge of 2% if the property is in an urban area, and 3% if it is in the rural parts.

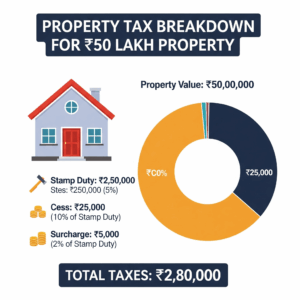

For example, if your property costs ₹50 lakh, the stamp duty will be 5% (₹2.5 lakh). Then you add 10% cess (₹25,000) plus 2% surcharge (₹5,000). That means your effective stamp duty isn’t just 5%, but now it’s closer to 5.6%.

Here is another example, for a property worth ₹50 lakh:

- Stamp duty = ₹2.5 lakh (5%)

- Cess (10%) = ₹25,000

- Surcharge (2% urban) = ₹5,000

Total = ₹2,80,000

See how the numbers add up quickly?

This is why people often search for a stamp duty registration charges calculator to have clarity beforehand. Because yes, numbers can be confusing when it comes to stamp duty charges in Bangalore, but with a simple calculation, you can get a better idea of the total.

Registration Charges in Bangalore

Now let’s talk about the second half of the cost, that is, the registration charges in Bangalore. Unlike stamp duty, which changes with property value, registration charges are flat: 1% of the property value.

So, whether you’re buying a ₹25 lakh apartment or a ₹1 crore villa plot, the property registration charges in Karnataka will be exactly 1% of the property’s value. That’s why when people ask what is the difference between stamp duty and registration fees, the answer is simple: one is a tax (stamp duty) and the other is a fixed legal fee (registration). Put together, you’ll be paying stamp duty + cess + surcharge + registration charges.

When combined, the two make up your Karnataka property registration charges, and well, you cannot skip them if you want your property to be legally yours!

What Is Stamp Duty And Registration Charges Calculator & How To Calculate?

Want to find the quickest way to figure out your total cost? Then you are in the right place! The easiest way to know your cost is to use a stamp duty registration charges calculator. And the good news is that the Karnataka government has made it available through the Kaveri Online Services portal.

All you have to do here is enter your property value, location, and type (residential plot, villa, or apartment), and it gives you the exact stamp duty and registration charges in Bangalore.

Here is a quick example for you:

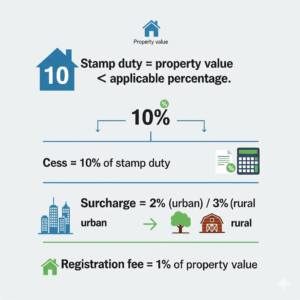

Stamp duty = property value × applicable percentage

- cess (10% of stamp duty)

- surcharge (2% urban / 3% rural)

- registration fee (1% of property value)

So, this is how the numbers will look:

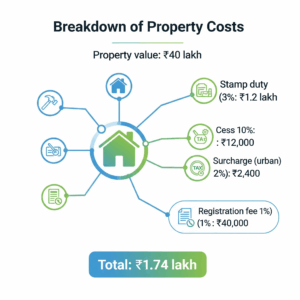

- Property value: ₹40 lakh

- Stamp duty (3%): ₹1.2 lakh

- Cess (10%): ₹12,000

- Surcharge (urban 2%): ₹2,400

- Registration fee (1%): ₹40,000

- Total = ₹1.74 lakh

This way, the stamp duty registration charges calculator removes all guesswork and will give you a clear picture of what you are stepping into, financially.

Process: How to Pay & Register

Okay, now that you know the numbers, how do you actually pay the stamp duty and registration charges in Bangalore? The process is simple but has to be done right:

You have two ways:

Online Payment:

- Visit the Kaveri Online Services Portal

- Enter the property details and buyer/seller information

- Pay the stamp duty charges in Bangalore and registration charges in Bangalore online through net banking.

Offline Payment

- Book a slot at your local sub-registrar’s office.

- Carry the sale deed, ID proofs, and payment receipt.

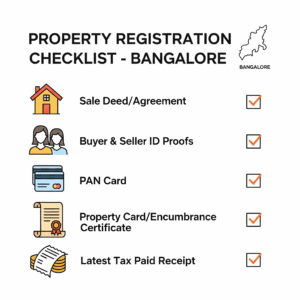

Once you know what is stamp duty and registration charges in Bangalore, keep a note of this checklist for you about all the key documents you will need during the whole process:

- Sale deed/agreement

- Buyer & seller ID proofs

- PAN card

- Property card/encumbrance certificate

- Latest tax paid receipt

And once you have paid the property registration charges in Karnataka and stamp duty, your property is officially in your name! If you miss this, then that means your ownership is not legal yet, no matter how much you have paid.

Also Read : What Is FSI (Floor Space Index) & Why It Matters for Plots

Conclusion

Understanding what is stamp duty and registration charges in Bangalore is just as important as knowing the price of the property itself. Also, these are not hidden costs, but the legal ones that actually safeguard your ownership and are made to protect your investment. Once you know what is the difference between stamp duty and registration fees, how to use the stamp duty registration charges calculator, and what the property registration charges in Karnataka actually are, the entire buying process becomes much less confusing!

Ready to find your perfect property?

Explore our premium villa plots with Guru Punvaanii and take the first step toward building your dream home with complete peace of mind.