Purchasing a house is one of the significant financial choices in anyone’s life. Due to increasing property costs, most buyers are now considering the alternative of investing in a developing property instead of an available apartment.

Although this option has appealing advantages like affordability, ease of payment, and interior customization possibilities, it also involves some risks that need to be reviewed with caution by buyers.

If you are pondering whether or not it is wise to invest in under construction property, this blog will take you through the important factors you need to be aware of before making your decision.

Table of Contents

Toggle1. Evaluate the Builder’s Reputation

The first thing to do when considering an apartment under construction for sale is to look up the builder. A credible developer with a good past record of timely completion reassures you that your investment is safe.

Verify:

- Previous works and if they were completed within time.

- Construction quality and performance of promises made.

- Testimonials from satisfied customers and RERA (Real Estate Regulatory Authority) compliance.

Reliable companies such as Guru Punvaanii tend to point towards safe builders, providing you with a place to begin your research. Keep in mind, a reliable builder negates half the risks of buying under construction properties.

Transition: After you are sure about the builder, the second most important step is to confirm the property itself has all the lawful approvals.

2. Check Legal Approvals and Documentation

Even when the builder is very good, you need to cross-check all the lawful clearances. Some of the buyers skip this step and run into trouble later. Before you sign any agreement, ensure the project has:

- Clear land ownership and title deed

- Valid RERA registration number

- Building plan approvals, commencement certificates, and environmental clearances

You should also learn about the sale deed of under construction property. It transfers ownership formally once the construction is over. You should get the deed checked by a lawyer to avoid any future disputes.

Transition: Once legal checks are done, your attention then turns to the payment plan and financial planning.

3. Learn about the Payment Plan

As opposed to ready-to-move apartments, purchasing a property under construction typically entails staggered payments. Builders may provide either:

- Construction-linked plans, where payments are triggered when construction is done

- Time-linked plans, where payments are made at predetermined intervals irrespective of progress

Carefully read the plan and ensure there are no secret charges. Parking charges, club charges, or maintenance charges can raise the cost substantially.

Think about how delays in the project will affect your finances, particularly if you are paying rent and EMIs together.

Transition: Very closely related to payment schedules is the builder’s delivery schedule, which must be examined with care.

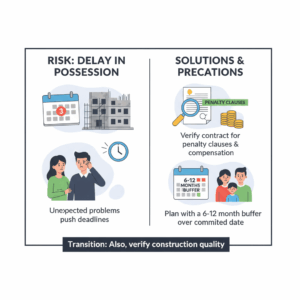

4. Verify Possession Schedule and Delay Clauses

Delay in possession is one of the key risks in under-construction developments. Although developers commit to a timeline for completion, unexpected problems tend to drive deadlines past the scheduled time.

Verify if the contract provides penalty clauses for delays with a guarantee of compensation in case the contractor does not meet the deadline.

Always consider a buffer of 6–12 months over the committed date. This pragmatic strategy leads to better planning and less stress if there are delays.

Transition: In addition to possession, you also need to check if the construction quality meets the claims.

5. Check Construction Quality and Specifications

An attractive brochure or chic model flat can be deceptive. Do not decide until you visit the actual construction site. Observe:

- Quality of materials used in flooring, plumbing, and electrical fixtures.

- Comparison between model flat and the current site progress.

- Facilities like car parking, power backup, water supply, and security.

Guru Punvaanii usually give feedback on construction quality and customer experience, which can aid you in making an informed decision.

While quality is important, you must also factor in the overall cost of your investment.

6. Understand the Total Cost of Ownership

The lowest price of a flat is seldom what you end up paying. The purchaser needs to factor in:

- Over and above the cost such as GST, registration, and stamp duty

- Maintenance cost and parking charges

- Processing charges for the loan and pre-EMI interest during the construction period

A clear picture of the overall cost of ownership avoids any financial shock later on. This also makes it easier to compare ready-to-move and under-construction options.

Transition: But before making a decision, it is important to consider the possible risks involved in purchasing an under-construction property.

7. Risks in Under-Construction Properties

Though advantages of purchasing under construction property include less price and greater scope for appreciation, there are disadvantages too. Some of these are:

- Delays in projects lasting years

- Increases in cost on account of material or regulatory changes

- Abandoned or delayed projects in worst-case scenarios

To protect yourself, always maintain alternatives for housing in the event of delay, and investigate fully into the financial condition of the builder.

Transition: Once you’ve weighed the risks, compare under-construction properties with ready-to-move ones to see which suits your needs better.

8. Compare with Ready-to-Move Options

Many buyers hesitate and wonder whether it is good to invest in under construction property compared to ready-to-move apartments. The choice depends on your financial flexibility and housing needs.

Under construction properties are often 10–20% cheaper, with better chances of price appreciation. They also offer flexible payment schedules.

- Ready-to-move houses offer instant possession, no GST, and no danger of project delay.

- By contrasting both, you can match your investment with your personal needs.

Transition: Once you have considered all the aspects, the final step is to make an informed decision.

To wrap up

Buying under construction property can prove to be a very good investment if done with care. Benefits of buying under construction property are affordability, payments at one’s own pace, and appreciation.

But buyers need to be careful about legal checks, reputation of the builder, date of possession, and risks.

With prudent due diligence and guidance from reliable sources such as Guru Punvaanii, you can reap the benefits and mitigate the risks.